multistate tax commission members

Commission members acting together attempt to promote uniformity in state tax laws. Establishes a commission whose purposes are 1 to facilitate proper determination of state and local tax liability of multistate taxpayers 2 to promote uniformity and compatibility in significant components of tax systems 3 to facilitate taxpayer convenience and compliance 4 seeks to avoid duplicate taxation 5 conducts audits of major corporations on behalf of.

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

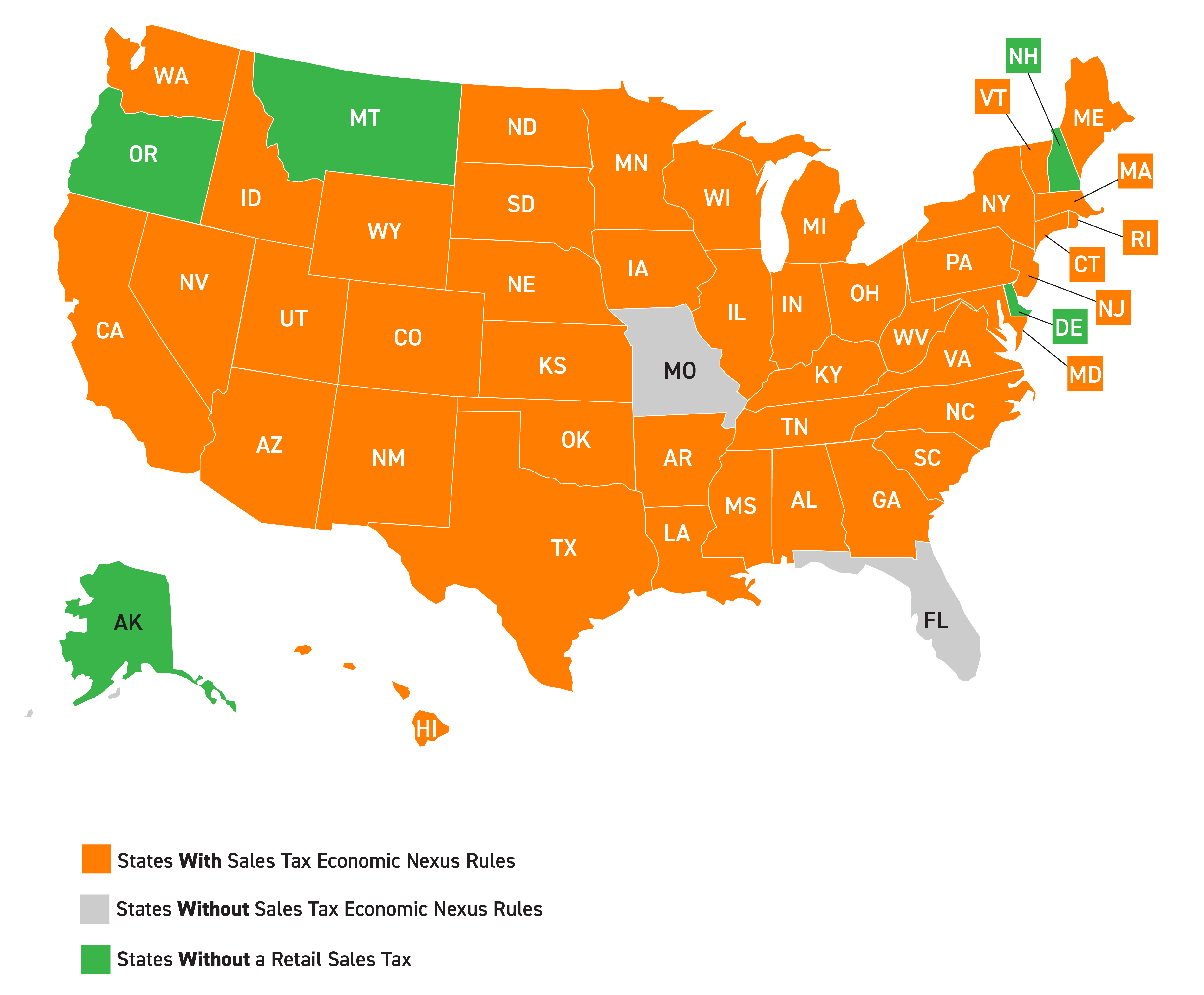

The Multistate Voluntary Disclosure Program MVDP provides a way for a taxpayer with potential tax liability in multiple states including the District of Columbia to negotiate a settlement using a uniform procedure coordinated through the National Nexus Program NNP staff of the Multistate Tax Commission Commission.

. Sovereignty member s are states that support the purposes of the Multistate. The Multistate Tax Commission is an intergovernmental state tax agency working on behalf of states and taxpayers to facilitate the equitable and efficient administration of state tax laws that apply to multistate and multinational enterprises. AssociateProject members are members that participate in.

There are currently 16 Compact Members including Colorado Texas Washington and the District of Columbia and 26 AssociateProject members including Illinois New York and California. Rather the court found that the Compact is an advisory compact because 1 the Commission is not a regulatory body with the power to regulate state taxation in the member states 2 the. As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity.

Definition of Member States Compact members are states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law. Our Multistate Tax team at Deloitte strives to deliver integrated tax approaches that align with a clients overall business objectives. Our professionals are committed to helping clients manage the broad range of complex state and local tax issues at all stages of a companys life cycle.

He was also the State Tax Notes Notable Tax Administrator of 2016 and featured in that publications Spotlight article September 2015. Section 7-5-3 - Appointment of multistate tax commission member. The Supreme Court ruled that the Multistate Tax Compact is not a binding contract.

MEMBERS OF BBB NATP. 86-272 income tax immunity. The Commission does not.

The Executive Committee meets quarterly and is comprised of the Commission Chair Vice-Chair Treasurer and four elected members. 86-272 was passed by the US. The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co.

The Multistate Tax Commission MTC is set to revamp its transfer pricing collaboration and enforcement initiatives following the first public meeting of its State Intercompany Transactions Advisory Service SITAS Committee in over four years. MultiState provides those vital tools that we need to deliver results for our members and ensure that we stay on the leading edge of what is impacting the industry and our members at all levels of government. 53 rows The Commission offers services to the public and member states.

Created by the Multistate Tax Compact the Commission is charged by this law with. NM Stat 7-5-3 2016 7-5-3. Compact members are states represented by the heads of the tax agencies administering corporate income and sales and use taxes that have enacted the Multistate Tax Compact into their state law.

The Executive Committee is the primary policy and administrative decision-making body of the MTC when the full Commission does not meet. Congress in 1959 and protects businesses from the imposition of state income tax when the businesss only activity in the state is the solicitation of orders of. The Multistate Tax Commission is an interstate instrumentality located in the United States.

Having the tools to get the job done right is critical. It is the executive agency charged with administering the Multistate Tax Compact. Joe is the 2015 recipient of the Paull Mines Award the Multistate Tax Commissions award for significant contributions to state tax jurisprudence.

It shall be composed of one member from each party State who shall be the head of the State agency charged with the administration of the types of taxes to which this compact applies. The Multistate Tax Commission MTC is updating its Public Law 86-272 guidance Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States under Public Law. MultiStates tracking and research services arm you with the intel you need.

This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the sellers PL. The Multistate Tax Commission MTC adopted its long-awaited guidance interpreting Public Law PL 86-272 protections for internet businesses on August 4 2021. At the end of last year the SITAS Committee appointed its new Chair- Krystal Bolton who is also an.

Organization and Management a The Multistate Tax Commission is hereby established. Multistate tax commission members. The governor shall appoint the member of the multistate tax commission to represent New Mexico from among the persons made eligible by Article VI 1 a of the compact 7-5-1 NMSA 1978.

Rest easy knowing your taxes will be properly handled every single year with the help from the experienced team at Multistate Tax Inc. Appointment of multistate tax commission member. Multistate tax commission model multistate tax compact accessed february 17 2021 the multistate tax commission mtc was created by the multistate tax compact and is charged with facilitating the proper determination of state and local tax liability of multistate taxpayers there are currently 16 compact members.

An intergovernmental state tax agency whose mission is to promote uniform and consistent tax policy and administration among the states assist taxpayers in achieving compliance with existing tax laws and advocate for state and local sovereignty in the development of tax policy. The California Supreme Court reversed the decision of the Court of Appeal. These states govern the Commission and participate in a wide range of projects and programs.

A To assist in the conduct of its business when the full Commission is not meeting the Commission shall have an Executive Committee of seven members including the Chairman Vice Chairman Treasurer and four other members elected annually by the Commission. These states govern the Commission and participate in a wide range of projects and programs. Get a brief overview of Multistate Tax and see our current team of knowledgeable and dedicated employees.

Deftly Navigating An Mtc Audit Considerations For Taxpayers Tax Executive

.jpg.aspx)

Multistate Tax Commission News

Multistate Tax Commission With Helen Hecht Taxops

Multistate Tax Commission News

Multistate Tax Commission Home

The Significance Of The Multistate Tax Compact And Uditpa Amid Recent Developments Accountingweb

Multistate Tax Commission Home

Multistate Tax Commission S View Of P L 86 272 Is Changing

Mtc Mission Values Vision Goals Multistate Tax Commission

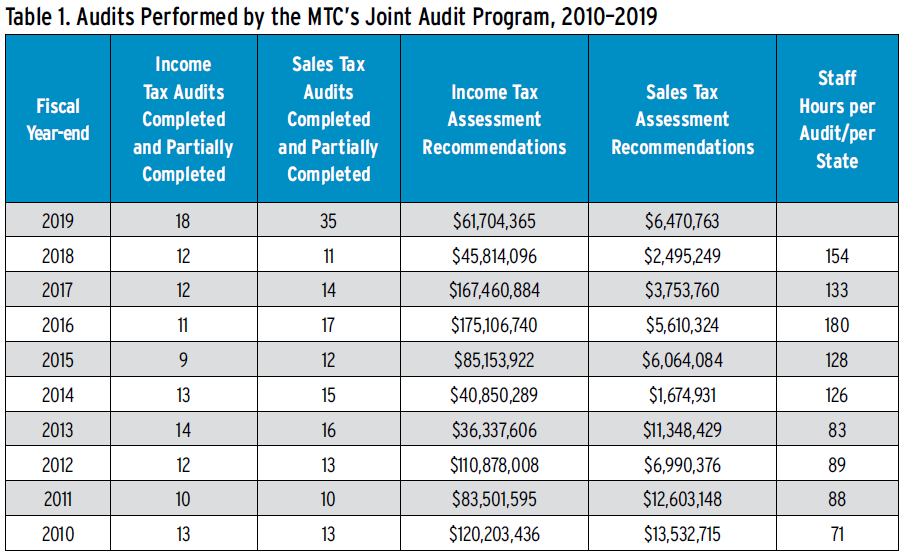

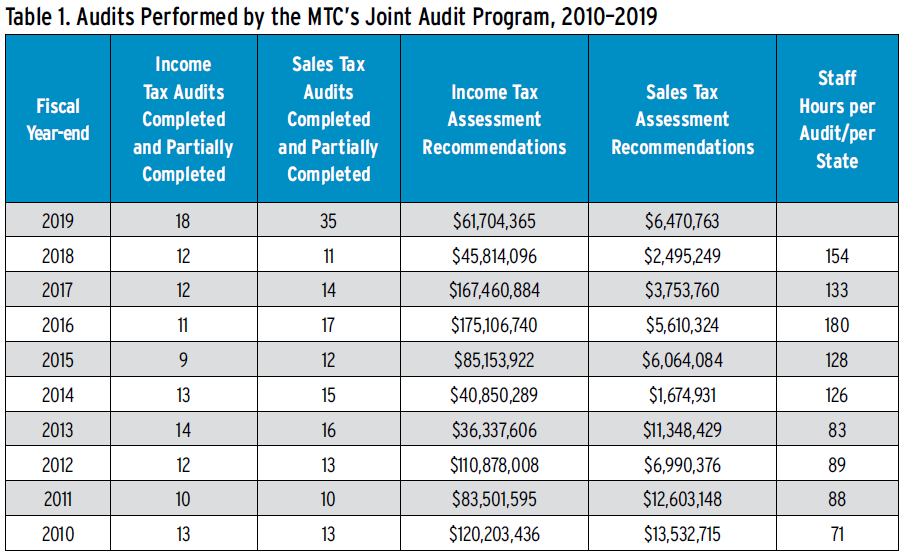

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

Staff Memorandum And Draft Model Statute Multistate Tax

.jpg.aspx)

Multistate Tax Commission News

Staff Memorandum And Draft Model Statute Multistate Tax

Mtc Adopts New Internet Rule Regarding Pl 86 272 Redw